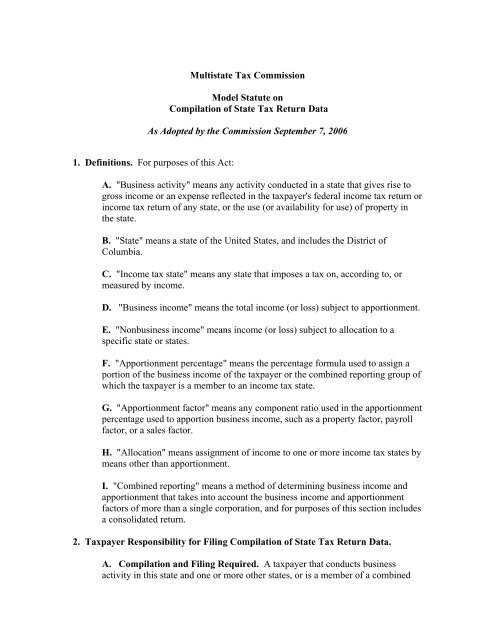

multistate tax commission allocation and apportionment regulations

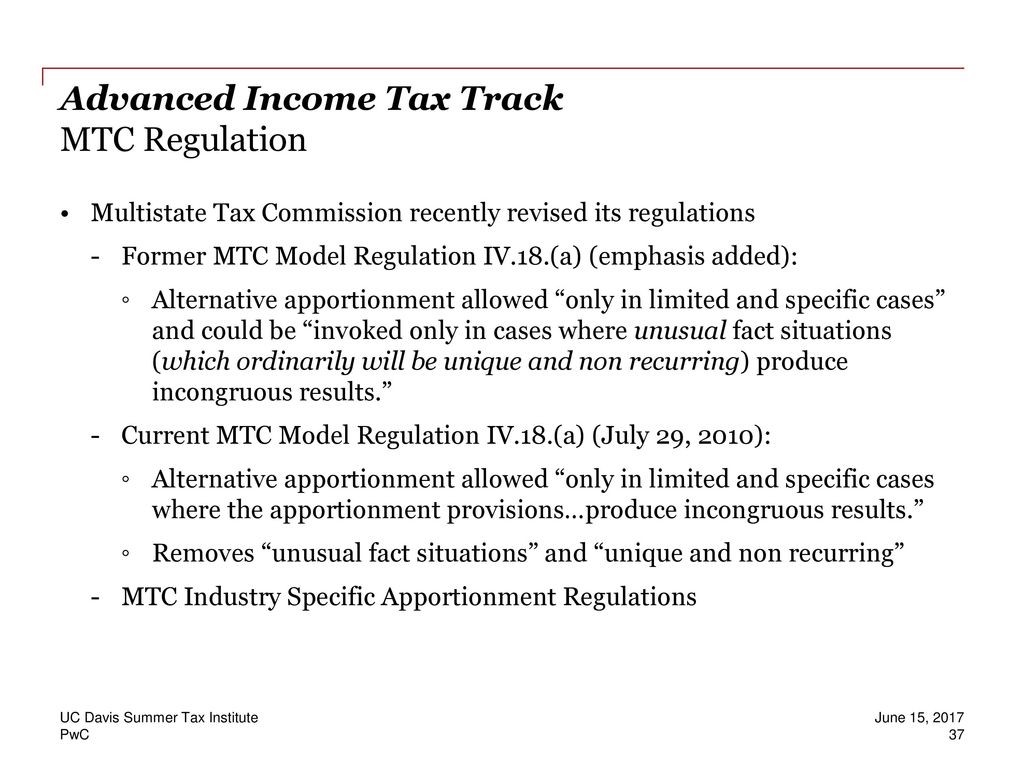

Application of the apportionment and allocation provisions of Article IV of the Multistate Tax Compact. Multistate Tax Commission Allocation and Apportionment Regulations as adopted February 21 1973 and revised through July 29 2010To help determine whether a group of affiliated.

Multistate Tax Commission Home

While the New Jersey headlines last week trumpeted a new deal intended to save the troubled Xanadu project in the Meadowlands the governor also signed two pro-business tax bills that.

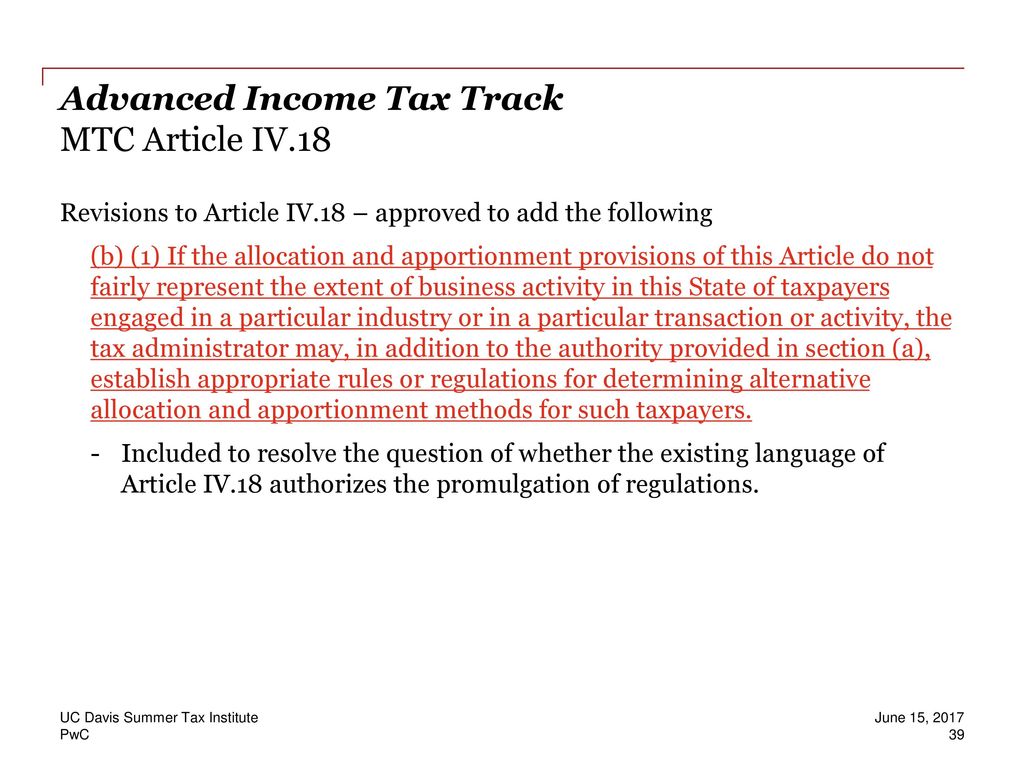

. 1 See Resolution Adopting Amendments to the Multistate Tax Commissions Model General Allocation and Apportionment Regulations Special Meeting of the MTC February 24 2017 a. Comeau In recent years states have. Multistate Tax Commission Model General Allocation and Apportionment Regulations Current as of 2017 2 PREFATORY NOTES These prefatory notes and the drafters notes below are.

Allocation and Apportionment Regulations. These Regulations are intended to set forth rules concerning the. On February 24 2017 the Multistate Tax Commission adopted amendments to its Model General Allocation and Apportionment Regulations.

48 State Tax Notes 1063 June 30 2008 Multistate Taxation of Stock Option Income -- Time for a National Solution. This rule is intended as an interpretive guideline in the application of Article VI of the Multistate Tax Compact section 32200 RSMo implemented by adopting the Multistate Tax. Potential Tax Pitfalls Attorneys also need to carefully draft tax-apportionment clauses to take into account the impact of how estate and inheritance taxes are allocated and come up with a plan.

As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of. Noonan and Paul R. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General.

Adopted February 21 1973. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General Allocation and Apportionment. USA February 28 2017.

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download

Eversheds Sutherland On Twitter Multistate Tax Commission Mtc Adopts Allocation And Apportionment Regulations Https T Co S0v1teel1x Tax Statetax Https T Co Vzxupukx4p Twitter

Why States Should Adopt The Mtc Model For Federal Partnership Audits

Tennessee Cpa Journal May June 2016

Kentucky Issues New Tax Regulations Part 2 Frost Brown Todd Full Service Law Firm

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

California Supreme Court Disallows Mtc Election To Change Apportionment Formula Deloitte Us

Memorandum To Multistate Tax Commission

Pdf Formulary Apportionment And Group Taxation In The European Union Insights From The United States And Canada

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Pdf Interstate Tax Uniformity And The Multistate Tax Commission

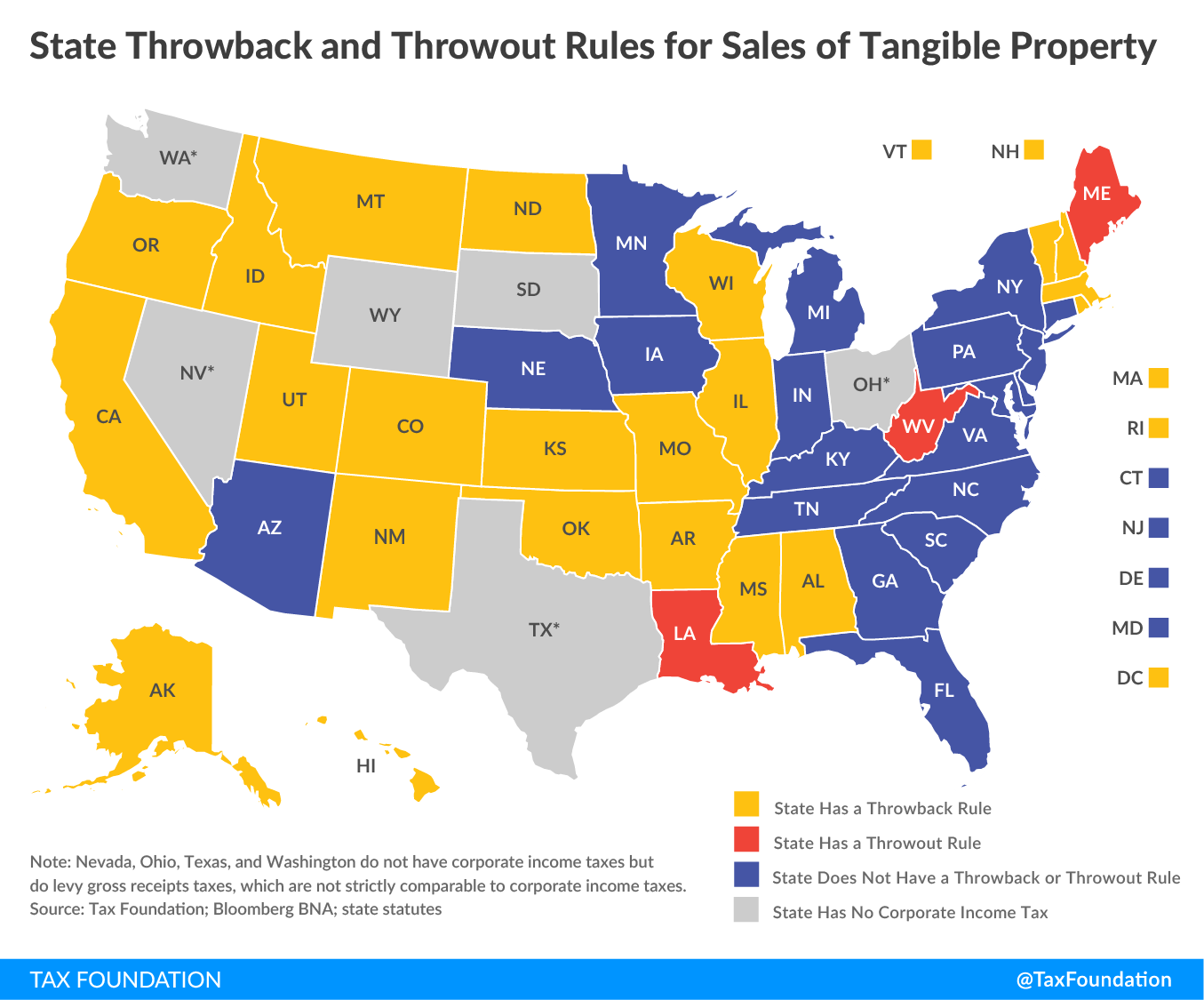

State Throwback Rules And Throwout Rules A Primer Tax Foundation

Unfair Apportionment Consider The Alternatives Tax Executive

Multi State Sales Apportionment For Income Tax Reporting Withum

Pdf Designing A Combined Reporting Regime For A State Corporate Income Tax A Case Study Of Louisiana

Fair Representation An Overview Of Alternative Apportionment In California Part 1